Rippling is

Built Different

MAY 11, 2022

Bedrock has co-led a $250m Series D in Rippling at a valuation of $11.25b post money with Kleiner Perkins. Prior to this round – which just closed – Bedrock had invested $35m in Rippling over several years beginning in 2019. Our Series D investment totals $125m, making it the largest investment we’ve made to date. For us, this is not just any investment; our long, winding, and idiosyncratic journey with Rippling began before we’d even founded Bedrock.

On March 15, 2017, the hero image in Axios’s Pro Rata newsletter was a GIF of actor Paul Rudd in “They Came Together” – an entirely mediocre film. Look at Mr. Rudd’s face:

If you can endure the film, you’ll hear Mr. Rudd saying “what?” as he makes this face. But we all know his facial expression means a lot more than “what?”... It means extreme skepticism. It means perplexed confusion. Mr. Rudd cannot believe what he is hearing is true.

Paul Rudd Face encapsulates how many in Silicon Valley felt when Parker Conrad announced Rippling’s seed round that day.

Back in 2014, Parker had been the toast of Silicon Valley as the Founder & CEO of Zenefits. Yet by early 2016, Zenefits was mired in scandal, and Parker was mercurially ousted as CEO. Like many entrepreneurs early on in their journeys, Parker made some mistakes with Zenefits; he’s been the first to admit that for years. But the degree to which Parker was scapegoated in the media and beyond was – in Bedrock’s estimation – outrageous.

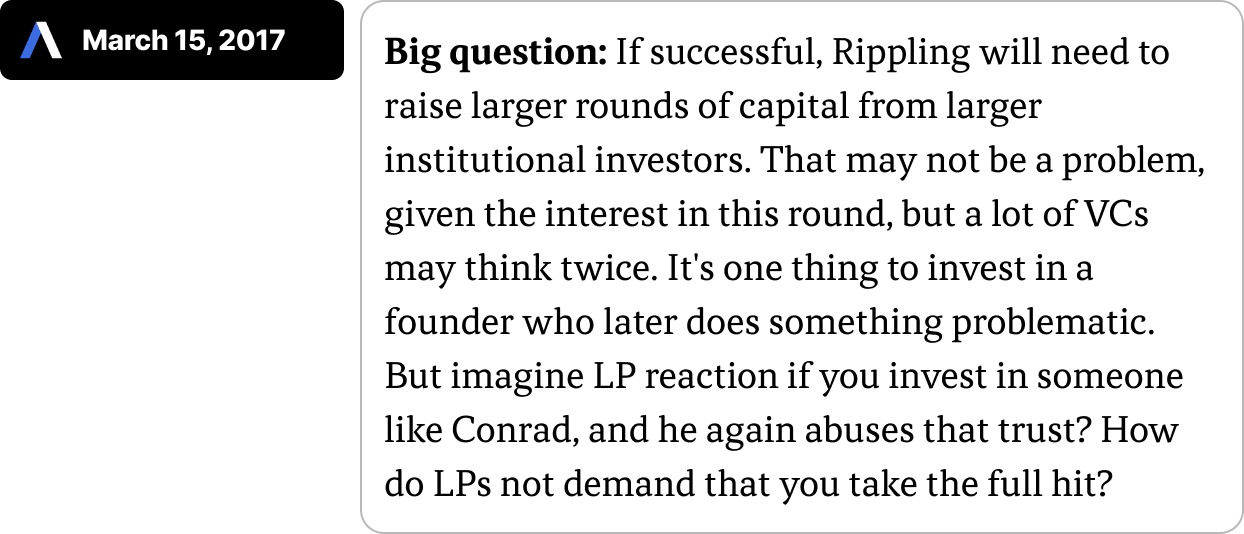

After reemerging with Rippling a year later, the anti-Parker campaign resurfaced. This time, it was specifically engineered to cast doubt on Parker’s trustworthiness within the LP community (limited partners; the underlying investors who back venture capital firms). Per Axios:

All of the above created the perfect – albeit unfortunate – set of conditions for Rippling to be radically underestimated by most venture capitalists at the outset; save for a few wise seed investors.

What so few understood then – but what has been powerfully proven out over time – is that Parker Conrad is one of very few individuals on the planet with the capacity to channel being scapegoated – an ugly act – into something beautiful: the creation of a product so transformational – and the construction of a team so extraordinary – that all of us at Bedrock are certain Rippling will bend reality for decades to come.

By the time he incorporated Rippling on May 10, 2016, Parker Conrad had been forged by a set of experiences so extreme, so trying, and so specific that they could only be healthily channeled into one thing; building this specific company.

Parker is built different.

Bedrock didn’t exist when the Axios piece dropped, but for years, Geoff had envisioned creating an investment firm, and he had known Parker Conrad to be a very special entrepreneur. Despite the skeptical narrative, we were intuitively drawn to Rippling. One problem; we hadn’t yet formed – let alone raised – our first fund. As first time fund managers who were met with an abundance of Paul Rudd Face in our earliest days, that would take some time.

One year later, in March of 2018, Bedrock launched with a letter: In Search of Narrative Violations. We wrote:

Rather than chase the narrative, Bedrock’s approach is to invest in promising companies that are underestimated precisely because they are incongruent with the storyline. Our starting point, therefore, is to search for narrative violations. When we find one, we do the work to build passionate conviction in opportunities that most overlook.

We ended with a call to action:

Against all odds, a few brave entrepreneurs violating the narrative today will come to define profound new truths tomorrow. We’re on a mission to find them.

Our search immediately led us back to Rippling. It embodied our mission; a company widely dismissed despite so obviously (to us) having the potential to be generational. Geoff visited the original Rippling office on Shotwell Street in San Francisco in May of 2018 and was given a demo of the not-yet-launched product.

Then and there, we unearthed a second layer to Rippling’s narrative violation. Conventional wisdom calls for entrepreneurs to launch a Minimum Viable Product into the market as quickly as possible and rapidly iterate, garnering feedback from customers in the process. While this wisdom has merit, Rippling took a different tack. Parker and the team spent three years quietly building an incredibly broad and deep multi product platform prior to launch. No salespeople. No marketing. No flashy image-repair campaigns… Just quietly building something transformational from a dingy office on Shotwell Street and an additional engineering hub in Bangalore.

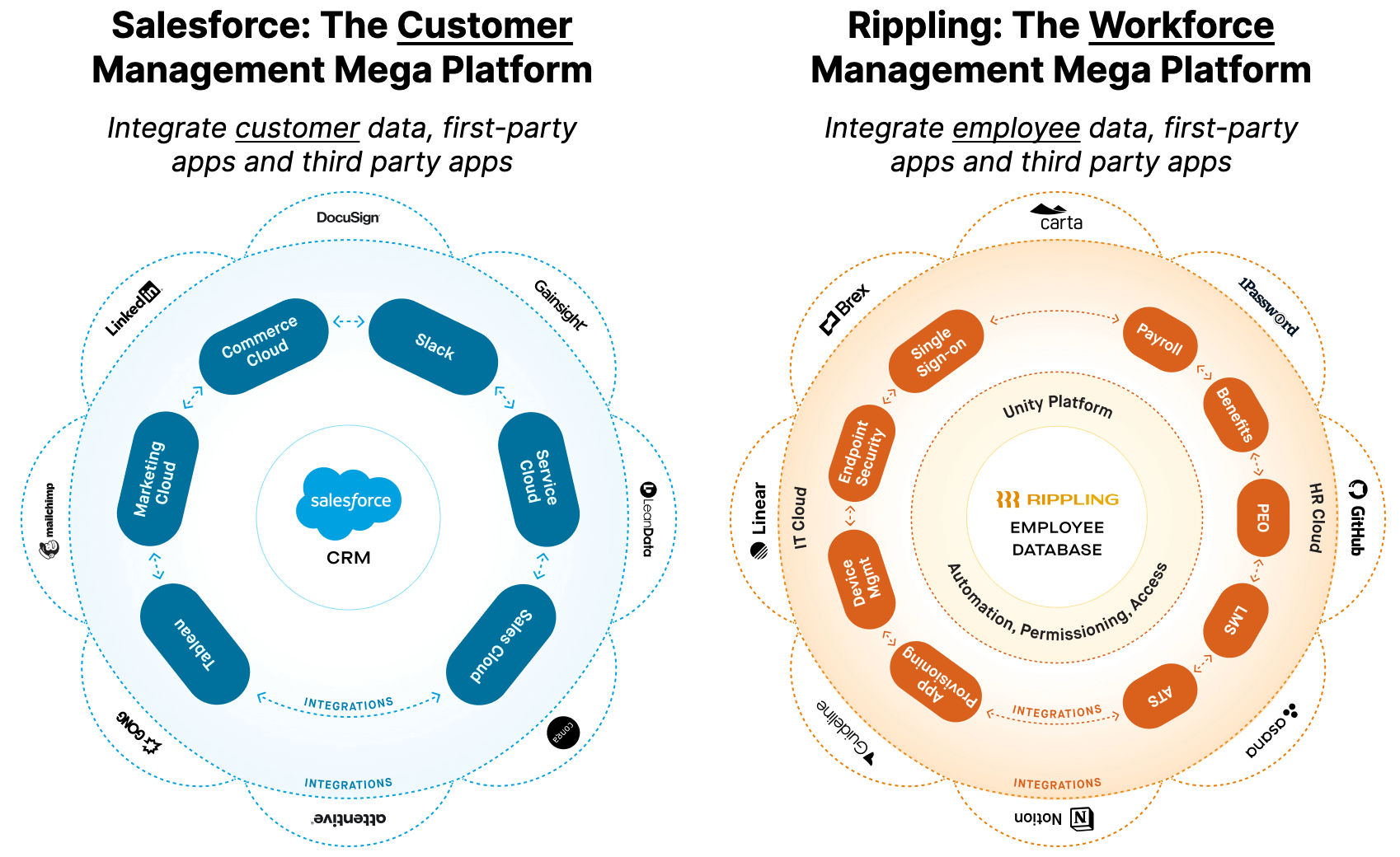

By something transformational, we mean the mega platform for workforce management:

Moreover, Parker had assembled a team that matched his purpose and determination. Many early Zenefits team members joined Parker in building Rippling, and they leveraged their intimate knowledge of payroll, HRIS, and benefits to imbue the company with advantages that would compound over time.

It was immediately clear to us that while Silicon Valley had largely forgotten about Parker, the world at large would soon know Rippling. We asked him if we could invest pre-launch at a $100m valuation in June of 2018.

Parker declined. Smart move.

Another year later, we received a most welcome email; Rippling was ready to raise their Series A. Bedrock rapidly mobilized and delivered a term sheet to lead the round on February 9, 2019.

We were outbid. It wasn’t even close. Being outbid on the Series A taught us a lesson: while price sensitivity is imperative in venture, one must always allow for rare exceptions to rules.

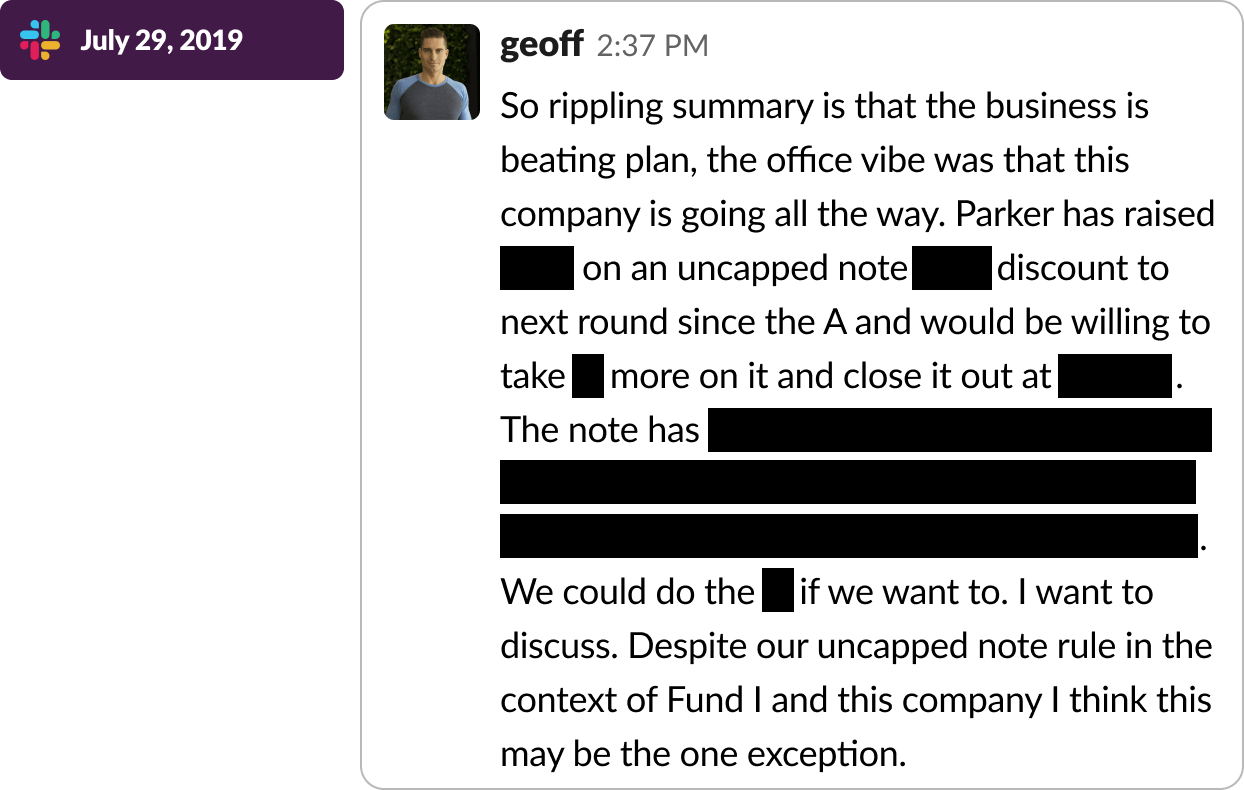

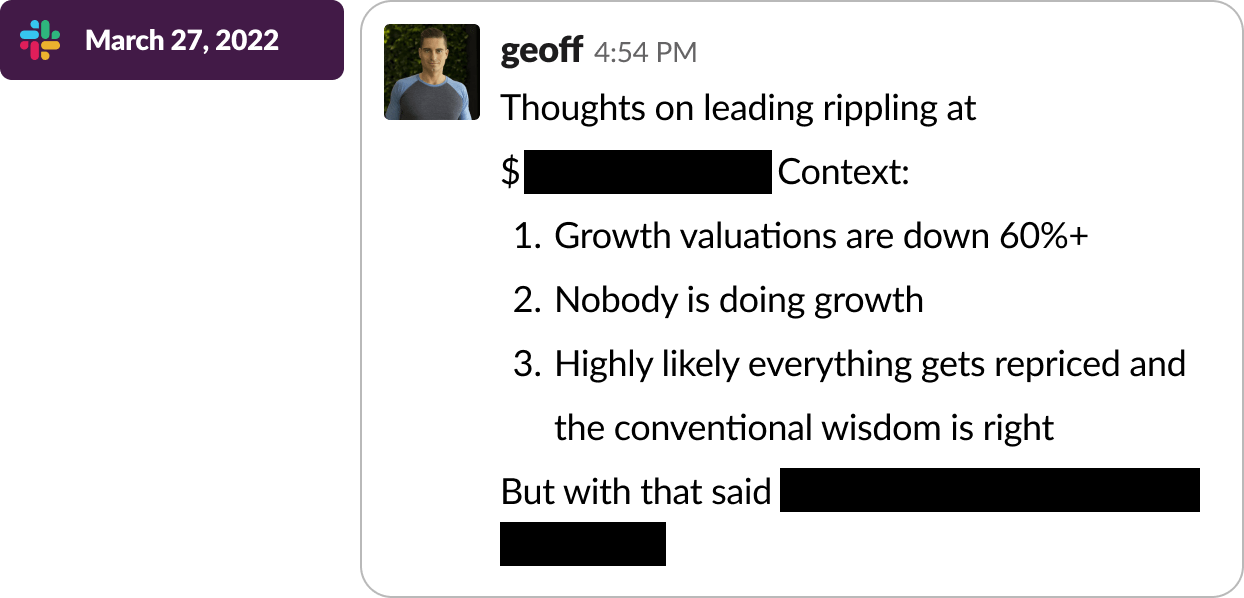

This lesson came to the fore in July of 2019 when Geoff sent a slack from the hallway outside Rippling’s office – he was struck by the “vibe.”

Bedrock had a rule that we would never invest on uncapped notes. These instruments have no valuation cap; definitionally the opposite of price sensitivity. But we broke that rule to establish our initial position in Rippling.

“I don’t have buyers remorse like I do with the bad ones,” slacked Geoff. Rather than buyer’s remorse, we soon wanted to lead the Series B.

We floated a verbal offer to lead the Series B a few days later. Parker declined. Again. He believed in the business trajectory and wanted to wait.

Then, something very interesting happened.

In February of 2020, the Bedrock team began debating the impact COVID would have on technology investing. We concluded that the macro overlay would turn sharply negative, and that this radical sentiment shift would present an opportunity for Bedrock to lead a round in Rippling.

On March 7, 2020, Geoff left New York City – recall, these were the early COVID days, and we anticipated that NYC would become an epicenter. Pausing at a rest stop in southern New Jersey after departing the city, Geoff pulled off his latex gloves, applied copious amounts of Purell to his fingers, pulled out his phone, and called Parker Conrad. “I think it’s time to raise your Series B,” he said.

Parker agreed.

As the world shut down over COVID, the Bedrock team revved up over Rippling. Eight straight days of due diligence and analysis. Multiple zooms with Parker and the Rippling executive team. At the end of it all, we agreed on a price, and were ready to press go.

What happened next? March 16, 2020.

The biggest single day drop the NASDAQ had ever seen. We knew COVID would be bad, but we’d underestimated the degree to which the once-in-a-lifetime negative macro psychology would impact our positive micro psychology on Rippling. Ultimately, we never issued a term sheet… perhaps the costliest decision in Bedrock’s history.

Yet Parker didn’t hold a grudge, and we were able to incrementally build a position of over $35m invested into the company over the ensuing years.

Still, not leading that Series B round stings.

Today, Silicon Valley knows that Parker Conrad is a transcendent entrepreneur.

The business traction is unrivaled. Most six year old companies are lucky to have one product line powerfully working. Rippling has ten product lines that are each above $1m in ARR.

The product strategy is next level. Rippling has integrated employee data, first-party applications, and third party applications into one mega-platform — placing it at the center of the relationship between companies and their employees.

We could write a book on the n of 1 quality of Rippling’s business. But to Bedrock, there’s an even bigger story.

When we wrote In Search of Narrative Violations in 2018, it was from our perspective as a new investment firm. Our focus was defining what narrative violations were, and how to find them as investors.

Yet we missed the other side of the equation; what it means to be an entrepreneur truly violating the narrative against all odds. How do tidal waves of detractors, doubters, skeptics, and saboteurs imprint an entrepreneur and the fabric of the company they create? How are the precious few narrative violations that transcend built?

Rippling provides the answer.

Every newly formed company is fragile in its earliest days. Most companies launch to either crickets or applause. Rippling launched to Paul Rudd Face. Tidal waves of detractors, doubters, skeptics, and saboteurs meant Rippling never had the luxury of being fragile. The waves will either break you, or — as in Rippling’s case — forge you into something stronger across every dimension. Otherwise investors, employees, and customers will simply move on to what they perceive as less risky alternatives.

From the day they launched, Rippling has been forced to constantly channel the force of rogue waves crashing up against them into strength…constantly and acutely aware that their products, strategy, and team had to be so good – so good – that the detractors, doubters, skeptics, and saboteurs could never wash Rippling away. So strong – so strong – that one day the rogue waves would simply evaporate.

This culture — even more so than Rippling’s unparalleled product — is the advantage we expect to compound dramatically over the decades to come.

Rippling has been a narrative violation since the day Parker founded it — constantly underestimated by almost everyone at every turn. How Parker and the Rippling team have channeled this inbound negative energy – which would destroy most humans; let alone most companies – into a generative force propelling the business forward will be studied decades from now.

Rippling is built different.

If there is one certainty in the market today, it is that one should not lead growth rounds.

Everything has been melting down since January. The meltdown keeps getting worse.

Mid-cap growth tech stocks are down 60%+. We anticipate they’ll fall further.

Even Dogecoin — the backbone of our digital future — is down 80% to a measly market cap of $14b. Just $14b? For the #1 dog meme cryptocurrency? That’s either insanity or lucidity…Time will tell.

Many venture funds aren’t allocating at all. Crossover funds have pivoted to Series A.

Growth is no place to be.

Right?

We agree wholeheartedly.

But our idiosyncratic journey with Rippling – and with Parker – has solidified our belief that they are amongst the rare and precious few that will flourish even more profoundly amidst a macro meltdown.

Let the markets crash like the tidal waves that have been crashing into Rippling since its inception; like the rogue waves that have been crashing into Parker for well over a decade. The company and its leaders will simply be forged into something stronger tomorrow than they are today. They are built different.

Over the 45 days since Geoff sent that slack, the Bedrock team has spent more hours analyzing Rippling than we’ve spent sleeping. Our conclusion is that in building the critical primitive for business, Rippling is on a clear trajectory toward becoming a generational company.

While we suspect that investing $125m to co-lead this financing round amidst a macro meltdown may spur some Paul Rudd Face, rest assured that we’re prepared.

Indeed, Rippling encapsulates our narrative violations mission so precisely that it will be hard to beat...

Thank you Parker.

Sending best vibes.

This essay contains forward-looking statements within the meaning of the U.S. Securities Act of 1933, as amended (the “Securities Act”). Such statements are based upon current expectations that involve risks and uncertainties. Any statements that are not of historical fact, may be forward-looking statements. The words “anticipates,” “believes,” “continues,” “designed,” “estimates,” “expects,” “goal,” “intends,” “leverage,” “likely,” “may,” “ongoing,” “path,” “plans,” “projects,” “pursuing,” “seeks,” “should,” “will,” “would” and similar expressions (including the negatives thereof) are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. The plans, intentions, expectations or objectives disclosed in our forward-looking statements may not be achieved, and the assumptions underlying our forward-looking statements may prove incorrect. Therefore, you should not place undue reliance on our forward-looking statements. Actual results or events may differ significantly from the results discussed in the forward-looking statements we make. All forward-looking statements in this essay are based on information available to us as of the date of its initial publication, and we assume no obligation to update any such forward-looking statements.

Certain information contained in here has been obtained from third-party sources. While taken from sources believed to be reliable, Bedrock has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation.

This essay shall not constitute or be construed to be an offer to sell, or a solicitation of an offer to buy, any securities of an investment fund managed by Bedrock Fund Management, LLC.